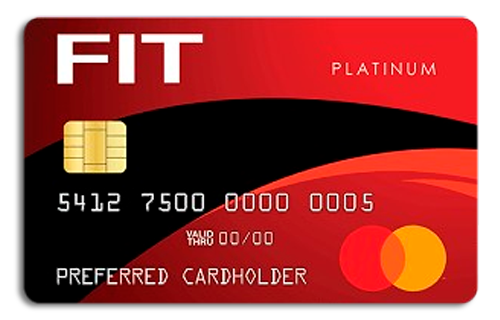

The Continental Finance Fit Platinum credit card is accepted worldwide and issues monthly reports to the main credit bureaus, making it a valuable tool for those seeking a solid financial journey.

If you are concerned about being accepted or maintaining a healthy credit history, it provides the confidence needed to move forward safely. This card was designed to be accessible, offering clear benefits aimed at those looking to consistently improve their personal finances.

Ready to explore all the details of this card and understand how it can fit into your financial life? Keep reading to discover everything about the benefits, fees, how to apply, and more!

About the card issuer

The Fit Platinum card is issued by the Bank of Missouri in partnership with Continental Finance, a company specialized in financial products aimed at consumers in the process of rebuilding their credit.

Founded in 1891, the Bank of Missouri is a financial institution with a long tradition of supporting customers who seek to restore their financial health.

With a solid reputation for offering accessible and reliable products, the bank works together with Continental Finance to ensure that the Fit Platinum is an effective tool for its target audience.

Trust in an issuer like the Bank of Missouri, in collaboration with Continental Finance, is essential for those rebuilding credit, and the Continental Finance Fit Platinum credit card fulfills this promise effectively.

Benefits

Monthly reports to the three main credit bureaus: The Continental Finance Fit Platinum card sends monthly reports to Experian, Equifax, and TransUnion. This is crucial for helping cardholders build a positive credit history over time, provided payments are made on time.

Automatic credit limit increase: After six months of on-time payments, the initial credit limit of $400 can be automatically doubled to $800. This encourages financial responsibility and offers more credit flexibility to the cardholder.

Access to the Vantage 3.0 credit score from Experian: The card provides access to your Vantage 3.0 credit score through the card’s online portal. This allows holders to monitor their progress in building credit.

Global acceptance with the Mastercard logo: The Continental Finance Fit Platinum card is widely accepted at millions of establishments worldwide, offering convenience and flexibility for purchases and payments.

Zero liability protection: As part of Mastercard’s benefits, the card offers zero liability protection, meaning the holder will not be held responsible for fraudulent transactions as long as they are promptly reported.

Optional Continental Credit Protection: This optional program offers additional protection by canceling your debt in case of unemployment, hospitalization, or disability, providing more peace of mind for the cardholder.

Continental Finance Fit Platinum Credit Card – Fees and commissions

The Continental Finance Fit Platinum credit card has an annual fee of $99 and a processing fee of $95, charged at the time of card activation. Additionally, the variable APR (Annual Percentage Rate) is around 29.99%.

These fees and charges may be updated by the card issuer, so it is recommended that customers visit the official payment method website to check the updated conditions.

Card limit

The initial credit limit for Continental Finance Fit Platinum is $400, ideal for those starting or rebuilding their credit history. This limit can be adjusted after six months of responsible use, when on-time payments can result in an automatic increase to $800.

This progressive adjustment helps create a positive financial history while encouraging discipline in credit use. After establishing a good credit profile, you may become eligible for credit cards with higher limits.

Positive points

- Monthly reports:The card sends monthly reports to the three main credit bureaus.

- Limit increase:There is the possibility of doubling the limit after six months of on-time payments.

- Credit monitoring:Access to the credit score allows you to track progress in rebuilding credit.

Negative points

- Annual fees:The $99 annual fee may be considered high for some users.

- High APR:The 29.99% APR is above average, making the card expensive.

- Processing fee:The $95 activation fee can be a significant upfront cost.

How to apply for Continental Finance Fit Platinum Credit Card

To apply for the Continental Finance Fit Platinum credit card, follow the steps below:

- Visit the official Continental Finance Fit Platinum card website;

- Check all the information about it and click on “Apply now”;

- Fill out the digital application form with your information;

- Review the terms and conditions before submitting the application;

- Submit the form and wait for the review;

- After approval, activate your card by paying the processing fee;

- Receive the card by mail and start using it.

How to contact Continental Finance

For support related to the Continental Finance Fit Platinum credit card, use the following channels:

- Phone: 1 866 449 4514

- Website: Visit the official Continental Finance Fit Platinum website for more information.

The Continental Finance Fit Platinum credit card is a valuable tool for those looking to build or rebuild their credit. Apply for yours today and start making purchases conveniently wherever you want!