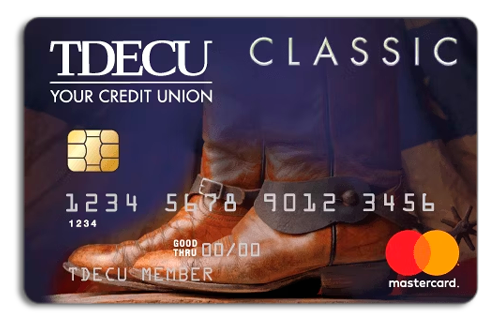

The TDECU Classic credit card is a popular choice for those seeking simplicity and accessibility in a payment method. It is especially attractive to those who want to manage their finances with ease, without complications or exorbitant fees.

At the forefront of cards designed for everyday use, it offers a combination of security and convenience, ideal for users looking for a reliable and no-fee financial partner.

If you’re looking for a card that balances practical benefits with accessibility, this card might be just what you need. Keep reading to see everything you need to know about this card, which could be your next financial ally.

About the Issuer

Texas Dow Employees Credit Union (TDECU) is one of the largest credit unions in Texas, with a history dating back to 1955. TDECU began as a small cooperative created to serve Dow Chemical employees but has since grown significantly, offering a wide range of financial products and services to its members.

TDECU has a commitment to the community and customer service, which sets it apart from many traditional banks. By choosing the TDECU Classic, you are not only selecting a credit card but also joining a financial institution that prioritizes its members and offers personalized support.

With over 330,000 members, TDECU continues to expand its services to meet the ever-evolving needs of its customers.

Benefits

No Annual Fee: The TDECU Classic is free from annual fees, meaning you don’t have to worry about additional costs throughout the year. This feature makes it an economical option, especially for those looking for a credit card for everyday use without having to pay for services they don’t regularly use.

Competitive Interest Rates: This card offers competitive interest rates, with APRs (Annual Percentage Rate) starting at 7.99% for qualified members. This is especially advantageous for those who may need to carry a balance from month to month, as it allows you to pay less in interest compared to cards with higher rates.

Fraud Protection: The TDECU Classic comes equipped with robust fraud protection. The card includes zero liability protection, meaning you won’t be held responsible for unauthorized purchases if your card is lost or stolen. Additionally, constant monitoring of fraudulent activities ensures your transactions are always secure, providing peace of mind when using the card.

Access to Mastercard Global Service: As part of the benefits offered by the TDECU Classic credit card, you also have access to Mastercard Global Service, which provides assistance with card-related emergencies anywhere in the world. This includes services like emergency card replacement and cash advances, which can be extremely useful when traveling.

Travel Accident Insurance: This card offers travel accident insurance at no additional cost. This means you are covered during your trips, providing more security and peace of mind. This benefit is particularly useful for frequent travelers, ensuring that you and your family are protected in case of unforeseen events.

TDECU Classic Credit Card – Fees and commissions

The TDECU Classic features a transparent fee structure, with competitive interest rates and no annual fee, making it an accessible choice. There is also a 0% introductory APR for 12 months, after which the rate ranges between 7.99% and 17.99%.

It is important to be aware that fees and conditions may change by the issuing bank, so it is advisable to regularly review the card’s terms to ensure you are always up to date with the latest conditions.

Card limit

The credit limit of the TDECU Classic is determined based on several factors, including your income, credit history, and current expenses. The credit evaluation process is thorough to ensure that the limit offered aligns with your financial capacity, promoting responsible credit use.

Once approved, you will be able to see what limit was granted for your case, and there will also be the opportunity to request a limit increase after using your card responsibly for a few months.

Positive points

- No Annual Fee:Ideal for those looking for a card with no additional costs.

- Competitive Interest Rates:Offers fair interest rates, favoring financial control.

- Fraud Protection:Robust security for your transactions.

Negative points

- Income Requirements:Requires proof of stable income.

- Initial Credit Limit:May be limited for new users.

- Limited Benefits:Does not offer rewards or cashback.

How to apply for TDECU Classic Credit Card

The TDECU Classic credit card can be applied for as follows:

- Access the TDECU website;

- Go to the “Credit Cards” section and select the TDECU Classic;

- Check everything about this payment method;

- Click on the “Apply Now” option;

- Fill out the form with the information requested by the bank;

- Submit your application for review;

- Once the card is approved, you should receive it and unlock it to start using it wherever you want.

How to contact TDECU

If you still have questions about the TDECU Classic credit card or want to get more information about it, be sure to contact TDECU through the official channels below:

- Chat: Use the chat available on TDECU’s official website;

- Phone: Contact them at 1-800-622-7747;

- Branch: Visit a branch to be attended to in person.

The TDECU Classic credit card is a practical and accessible option for those seeking simplicity in their daily finances. If you are looking for a reliable and secure card, consider applying for it today!